To order a home is a huge milestone many Australians hope to, but broadening economic pressures is actually making of numerous impression overwhelmed. Amid the fresh ascending can cost you out-of lifestyle and quickly increasing assets pricing, strengthening genuine coupons to put a home deposit to cover 20% of the house well worth and steer clear of spending lenders’ mortgage insurance policy is getting more hard than ever before.

Fortunately, there are some of good use systems that could help you get toward the house ely, no- and you will lowest-put home loan alternatives.

In this article, we are going to speak about just how zero- and you will reasonable-put lenders works, schemes that can help, including the Earliest Homeowners Give, and you can tips to acquire come.

Exactly what are Zero-Deposit Lenders?

Home loans instead very first dumps, known as zero-put mortgages, introduce an option selection pop over to this web-site for prospective home owners. This type of money permit individuals to and obtain property in the place of expenses many years strengthening legitimate savings and giving an upfront commission.

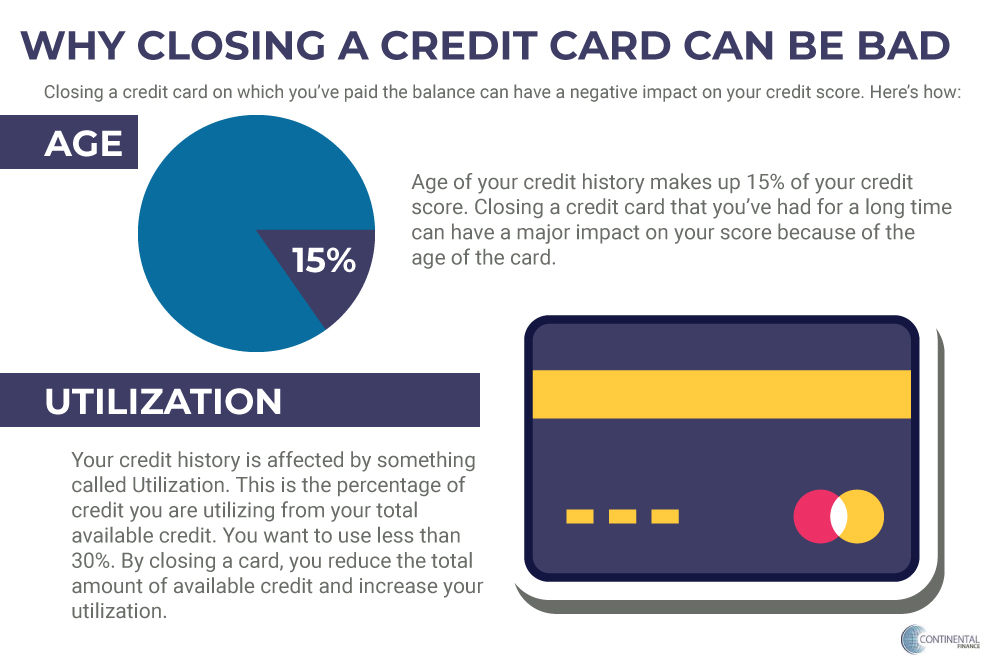

A typical requirement when purchasing a home would be to present a deposit of approximately 20% of the full worth of. This put provides one or two key aim: it evidences this new borrower’s preserving ability and you may commitment to advancing into the house ownership path. Without one, you would need to spend lenders’ mortgage insurance policies.

These zero- and you may lower-deposit mortgage brokers are beneficial for these looking to purchase the very first family. They ensure it is people to cover the full price of the house without any pressure off racking up a large share on deposit, and therefore and also make possessions ownership significantly more obtainable.

Guarantor Mortgage

The most popular choice one of first-homebuyers was Guarantor Home loans . The new arrangement allows a close relative, for example a daddy, to ensure a portion of the financing utilising the security into the their own property. In the place of providing an earnings put, the brand new borrower’s guarantor’ uses their home collateral since collateral, reducing the newest put standards.

Keep in mind that good guarantor financial does have commitments having the newest guarantor, who assumes part of the fresh new loan’s liability. If you fail to make the financing costs, the brand new guarantor could end right up since the costs.

Family home Make certain

Revealed inside 2021, the household Household Guarantee (FHG) are a governmental system to aid qualified single moms and dads inside the typing the home business. This new plan allows the acquisition out of homes using reduced-down put financing, requiring as little as dos% off. On the other hand, the federal government will bring a guarantee layer 18% of the house cost, effectively eliminating the requirement to possess Lenders’ Mortgage Insurance policies (LMI).

Earliest Financial Put Program (FHLDS)

Then there’s the initial Mortgage Put Program, an authorities-backed resident give that will help first-date home buyers buy a house sooner or later. Around FHLDS, eligible basic-date home buyers can buy a property having as low as a good 5% deposit, with the regulators promising up to 15% of your property’s well worth.

Criteria & Eligibility Conditions for no-Put Mortgage brokers

Making an application for a zero-deposit mortgage means more stringent financing criteria since you need to get send an average initial can cost you. To help relieve this process, we now have lay out various lender stipulations about how to remark:

Your financial situation

Overall, no-deposit lenders is mainly aimed at very first-go out homebuyers. These loans is ideal for anyone who has steady a position but be unable to save your self for a huge deposit. These include like good for those with high-living costs or other monetary duties, such as those who have only started its professions or possess has just accomplished discovering.

Your income & Employment Stability

Loan providers should be in hopes that one can see the loan money, therefore that have a stronger a career background and you can a consistent, enough money weight goes a considerable ways inside securing their acceptance.

Leave a Reply