We wish to ensure it is easier for you. For this reason i have partnered having AmeriCU Mortgage. They offer almost 3 decades off community experience undertaking one-of-a-type financial alternatives.

Should it be very first household or the fifth, another domestic within the Florida or a good cabin up northern, move in in a position or a good fixer higher, you can rely on AmeriCU to handle your.

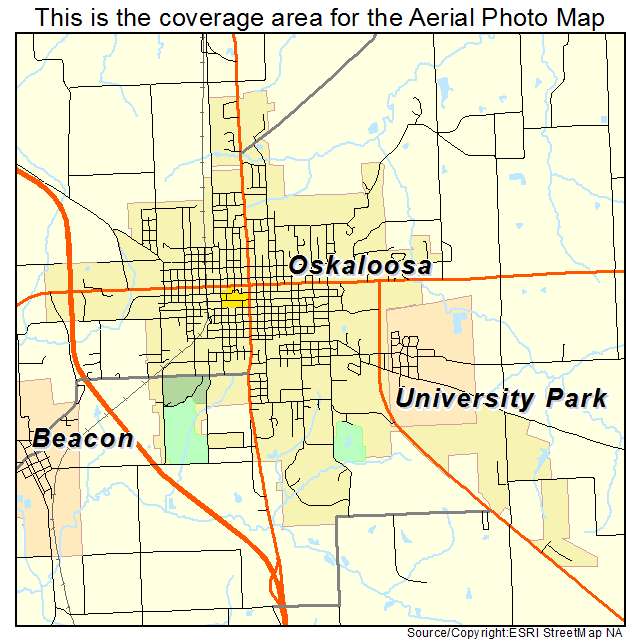

USDA fund is mortgages to possess property in eligible outlying parts and you may is backed by the usa Institution out-of Farming

The most famous hindrance so you’re able to homeownership today try saving sufficient money to own a mortgage deposit. AmeriCU Financial also provides downpayment or closing costs guidance up so you’re able to $dos,five hundred getting earnings-accredited consumers.^

Aggressive rates. Great customer care. A number of mortgage affairs. AmeriCU will bring you on your own dream house, easy peasy lemon squeezy.

- Old-fashioned

- FHA

- Virtual assistant

- USDA

- Buy Recovery

- Jumbo

A beneficial Virtual assistant loan is a home loan that is backed by the new Agencies of Pros Issues to possess veterans, active army team and you can armed forces spouses exactly who be considered

A traditional loan is among the most popular mortgage selection for players thinking of buying or re-finance property. They aren’t secured or covered because of the any authorities service and you may adhere to the mortgage limits place because of the Government Houses Fund Administration (FHFA).

An FHA financing is actually a mortgage given by the federally accredited lenders and you will backed by the fresh new Government Housing Management. Designed for lower-to-moderate income individuals that struggling to generate a large down payment- he’s generally a lot more flexible within the borrowing from the bank and you will earnings conditions than simply old-fashioned fund.

USDA funds try geared towards lower-to-reasonable money family seeking loans property. They offer low interest rates without deposit is needed.

Members get pick 203(k) Restricted & Fundamental in addition to HomeStyle products once they prefer Res so you’re able to complement big plus minor restoration will cost you, providing you with the flexibility accomplish a great deal more together with your new home. Talking to a home loan professional is the better answer to influence the applying right for you! For additional information on Repair, view here.

Good jumbo home https://simplycashadvance.net/personal-loans-mo/ loan was home financing to have an amount one is higher than conforming funds limitations lay from the Federal Houses Loans Institution (FHFA). This type of fund are made to loans luxury homes as well as services into the very aggressive areas.

A great Virtual assistant financing is a home loan which is backed by the brand new Company off Veterans Things to possess pros, energetic military personnel and you will military spouses exactly who be considered

A normal financing is one of prominent mortgage selection for members looking to purchase or refinance a home. They aren’t guaranteed or insured of the people government agency and you may follow the loan limits lay from the Government Property Funds Government (FHFA).

An enthusiastic FHA financing try a mortgage provided because of the federally qualified loan providers and supported by the latest Federal Casing Administration. Available for reasonable-to-modest income individuals that happen to be struggling to make an enormous off payment- he is usually alot more versatile inside the borrowing and you will money conditions than simply conventional financing.

USDA financing try targeted at low-to-moderate income household seeking money a house. They give low interest without down payment becomes necessary.

People will get pick 203(k) Limited & Basic and HomeStyle facts when they like Res in order to complement significant together with small recovery can cost you, giving you the flexibility doing a great deal more together with your new home. Seeing home financing top-notch is the best cure for determine the program most effective for you! For additional information on Recovery, click here.

An effective jumbo financial is actually home financing to possess a price you to definitely is higher than conforming funds limitations put from the Government Property Funds Institution (FHFA). These types of money are made to money deluxe home plus functions in highly competitive areas.

Financial qualities provided by AmeriCU Financial ^Advance payment/closing costs advice system is just found in conjunction which have certain antique compliant financing apps, into the get deals to have no. 1 homes. Advance payment/closure rates advice amounts depend on Urban area Average Money and you can almost every other eligibility standards and that’s used as the a credit within the loan closing processes. Promote may not be redeemed for money, and no change will be presented in the event the discount amount exceeds costs or even owed. Give is not transferable. Bring cannot be used retroactively. AmeriCU supplies the ability to cancel it give when. Homebuyer guidance try a requirement to sign up this choice. There can be an effective $99 counseling fee that is repaid by debtor.

Leave a Reply