What exactly is Predatory Financing?

Predatory credit try people lending practice that utilizes inaccurate or shady ways to encourage you to accept a loan less than unfair terminology or even accept a loan that you don’t absolutely need. Predatory loan providers usually target minorities, seniors, brand new faster experienced, additionally the worst.

Cash advance

Cash advance are generally predatory in general. Pay day loan try short-identity, high-notice fund, usually getting small amounts ($five hundred or quicker), which can be owed your upcoming pay check. Will, you have to supply the lender your finances pointers or make a check personal loans for bad credit Kentucky for a complete count upfront, that bank following cashes in the event the financing flow from. These types of funds are stated as quick assist to have surprise emergency.

Brand new Harms away from Pay day loan

- Payday loans cost a lot. Interest levels for payday loan are usually extremely high. The price of the loan (brand new finance charges) generally selections out-of $10$30 each $100 lent, thus a great $500 loan will include an extra $50$150. When you yourself have difficulties paying off the mortgage if it’s owed, such charge increases.

- Cash advance could harm their credit. Loan providers always require a upfront to cover the price of the borrowed funds, which they up coming dollars if the mortgage is due. For those who have dilemmas paying off the mortgage in case it is due or if there is certainly a problem with the loan money-getting to you punctually, one view could possibly get bounce and you will case one to standard into the loan. When this happens, the lending company you may declaration their standard so you can credit agencies, that destroy your borrowing from the bank. The financial institution might just be sure to sue your, and this can be filed on your own credit file and then have bring about destroy.

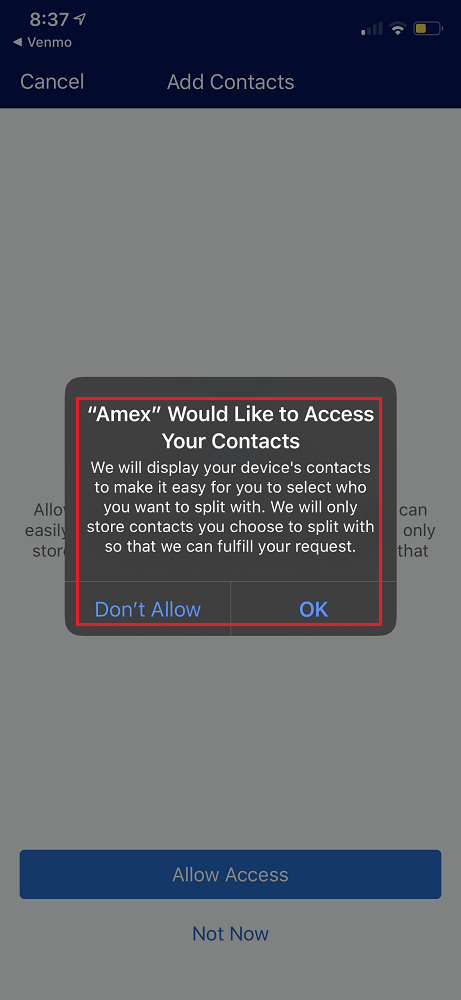

- Pay day loan providers is also need you to give them your financial recommendations. Rather than requiring an identify the loan number upfront, the lender might need your money advice. Should your date pertains to pay the financing as well as your account does not have sufficient finance, the lending company will get try several times so you can withdraw the cash, which can lead to overdraft charges from your own bank.

- Payday loans can cause commercial collection agency items. Of many pay-day lenders try business collection agencies-minded. They could plus offer your debt to a real personal debt collector. When you are incapable of spend the money for financing promptly, you may be harassed indebted range phone calls.

Vehicle Name Fund

Car identity funds are also generally predatory. Such as for example payday loan, automobile label finance is actually sold as the brief crisis loans borrowed in order to you for a little while, nonetheless supply quite high yearly rates of interest. To get for example that loan, you would need to give the lender the latest label of your auto. Generally, you would need to pay back the borrowed funds within thirty days, together with borrowing from the bank charge (these could getting large: often 25% of one’s number your use). If you cannot replay the loan, the lender can take the car.

- Look into that loan of a bank, borrowing from the bank connection, otherwise quick-lender. This type of towns often have more reasonable rates.

- Query to help you use the money out-of family unit members or friends.

- Correspond with a card specialist to own recommendations.

Business collection agencies

If you were incapable of shell out a loan timely and you can are in fact writing about commercial collection agency calls, listed below are some all of our debt collection and robocalls profiles having information on your rights within these circumstances.

Predatory credit methods, generally defined, would be the deceptive, deceptive, and you will unfair methods some people use to dupe us into financial finance that we can’t afford. Burdened with high home loan debts, the fresh subjects from predatory financing can’t spare the bucks to keep their homes during the a great repair. It filter systems merely to carry on their mortgage repayments. Commonly, the stress is simply too far. They succumb so you can foreclosure. Their homes was basically drawn ? taken ? from them.

Leave a Reply