Borrowing unions and you may loan originators approved in the yearly myCUmortgage Companion Appointment getting users to the property

BEAVERCREEK, OH () – The newest M.V.P.s of borrowing union financial industry was recently noted for the an excellent solution provided to their participants into the 15 th Annual myCUmortgage Spouse Appointment, kept October 22-24 inside Dayton, Ohio. myCUmortgage are the leading Borrowing Union Provider Business (CUSO) and you will completely-belonging to Wright-Patt Borrowing from the bank Connection.

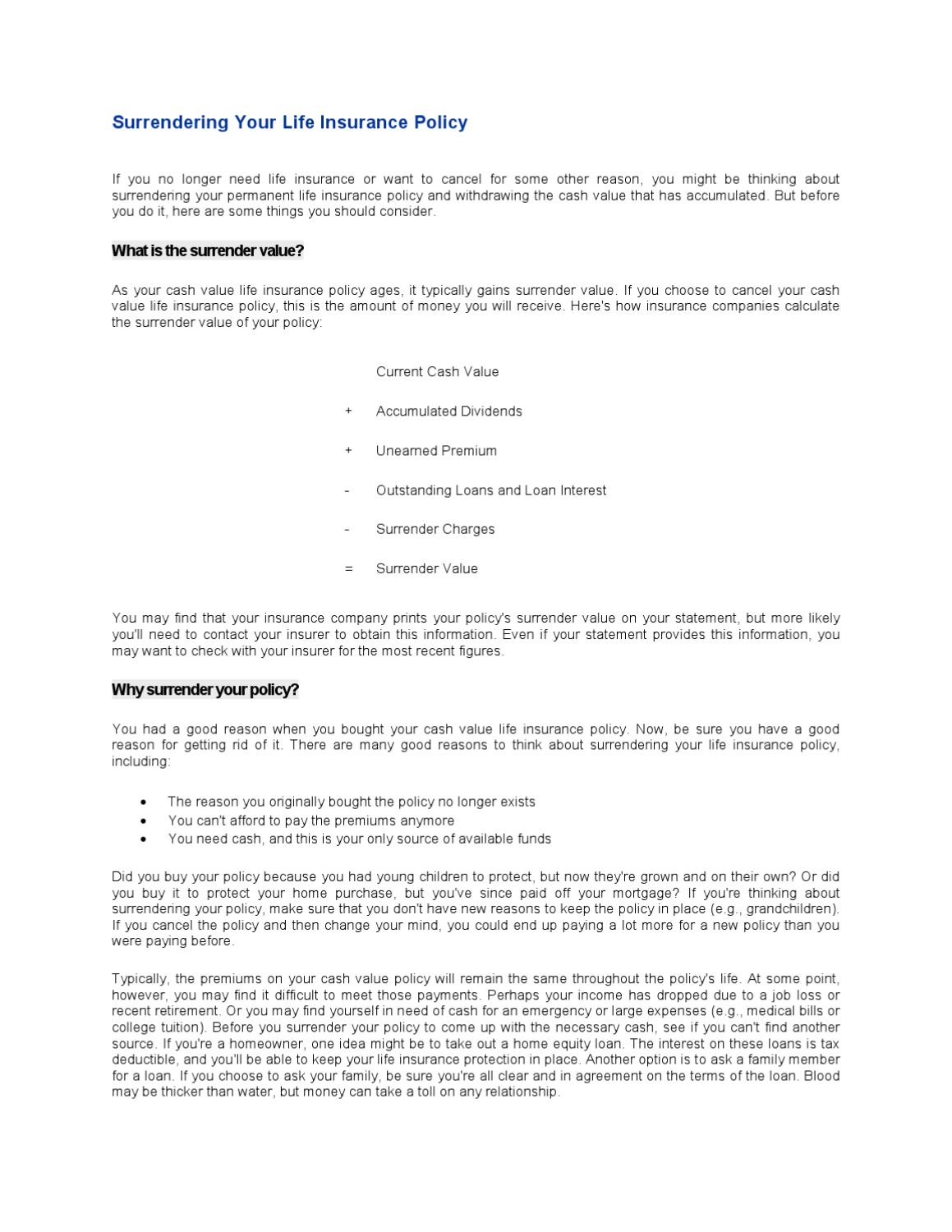

Exemplifying the 2009 meeting theme of Game Into!, 36 home loan originators and http://www.paydayloancolorado.net/steamboat-springs you may borrowing from the bank unions gotten honours getting starting the things they’re doing top-helping their players be homeowners. Brand new honours are based on the earlier 1 year and know the amount of players aided while the unique and you can imaginative stories behind the effective season.

Having today’s aggressive real estate market, getting honours for effortlessly bringing members into the house says a great deal from the all of our borrowing from the bank commitment lovers as well as their appeal to seize the newest financial, told you Tim Mislansky, Chairman of myCUmortgage and you may Head Method Manager, Wright-Patt Borrowing Union. Discover a great reason why these borrowing unions will always be successful-it is simply as they really Financial Such as for instance They Suggest They.

- High Borrowing from the bank Unions: Desco Government Borrowing Connection, Portsmouth, Ohio

- Mid-Measurements of Credit Unions: Midwest Society Government Borrowing from the bank Relationship, Defiance, Ohio

- Small Credit Unions: TopMark Federal Borrowing from the bank Connection, Lima, Ohio

Lowland Borrowing from the bank Partnership during the Newport, Tenn. is actually given this new Susan Edwards Grant. Titled pursuing the later Susan Edwards, an employee off myCUmortgage and you can strong recommend to possess small borrowing from the bank unions, the new scholarship is issued a-year to an inferior credit commitment one reveals excellence in aiding users which have home ownership. This new scholarship money attendance with the myCUmortgage Mate Appointment.

The 2009 meeting along with watched the inaugural presentation of your own Religion Honor to help you myCUmortgage Chairman Tim Mislansky. The latest honor is actually dependent and entitled to honor Mislansky as outbound President away from myCUmortgage when he moves on to his new role while the Chief Approach Administrator from the Wright-Patt Borrowing from the bank Relationship. The latest annual prize often accept an individual with a card commitment who exemplifies Mislansky’s faith on the importance of way of life your key viewpoints of working, domestic along with the community.

The fresh new 2019 Mate Fulfilling organized 110 borrowing union home loan management symbolizing 52 borrowing unions of along the United states. The fresh fulfilling brings going to borrowing union agents for the latest news, manner and methods regarding the financial globe and opportunity to exchange recommendations which have fellow borrowing from the bank union home loan representatives and you will circle with globe management.

SCOTTSDALE, Ariz., – CU Realty Qualities try recognizing the fresh new operate of a couple borrowing from the bank union clients-Wright-Patt Borrowing Partnership and you can Partners Government Borrowing from the bank Connection-having rescuing professionals currency through the HomeAdvantage program. HomeAdvantage is the turnkey real estate program of CU Realty Features-the largest a house CUSO on You.S.

Force

New Billion Money Pub comprehends borrowing unions with spared their home-to buy and you may home-attempting to sell professionals $1 million or even more in the form of HomeAdvantage Dollars Advantages. Users earn the money-straight back bonus regarding buying or selling a house using a genuine house representative on the HomeAdvantage system. The importance is equal to 20% of one’s agent’s earned fee.

Wright-Patt observed HomeAdvantage this season which have an objective to increase buy mortgage volume and deepen member matchmaking. By 2016, brand new CU got spared household-to get and you can family-attempting to sell participants $one million, getting an invest CU Realty’s Mil Buck Club. Now, only 2 years later on, the new Kansas-created borrowing partnership is at a whole lot larger milestone about club: $2 billion position.

Lovers Government Credit Relationship observed CU Realty’s HomeAdvantage a home system when you look at the 2013. Within just 5 years, the credit relationship that serves personnel of Walt Disney Providers, are honoring its induction to the Mil Buck Pub on $one million top.

Leave a Reply