- Lives financial: the quantity to get paid back includes the first and you will people then amounts borrowed as well as attract that is accumulated in the name of your financing. There will be no very early payment costs payable adopting the past citizen dies, however the loan continues to accrue attract through to the plan is actually settled entirely.

- House reversion: should your house is marketed, brand new seller will get their assented fee display of one’s finally business price, with things remaining gonna the estate.

Although the family will always become sold to repay this new equity launch package, this won’t have to be the way it is. Which have a lifestyle financial, the new vendor is interested on the fees, not the house in itself so if your own beneficiaries decide which they wants to support the family as opposed to selling it, they actually do have the option to repay the loan together with other funds if they have all of them readily available.

Which have property reversion bundle, our home does need to be ended up selling, as a key part otherwise all of it ily could get right back the property about seller, but this might be likely to be more expensive compared to the amazing sum reduced of the merchant, because would need to be obtained right back at economy worthy of.

South Carolina personal loans online

What happens for individuals who circulate complete-big date into a worry household?

For people who transfer to enough time-term care and attention accommodation, the fresh new understanding is you will not be moving back again to their family. When this occurs, the equity discharge bundle tend to end and need certainly to pay off brand new merchant.

For people who borrowed jointly, the program continues up until their thriving lover often passes away or and gets into permanent much time-name worry.

Whether your provider is actually reduced so there are funds left, such might need to be employed to loans brand new care can cost you, possibly for personal and state-financed worry. Neighborhood council will carry out an economic evaluation (form sample) to see how much cash you might need to expend. When you have assets over ?23,250, the fresh council wouldn’t subscribe prices for your proper care (within the The united kingdomt and you can Northern Ireland on financial seasons 2024-twenty-five additional pricing implement In the Scotland and you can Wales).

What are the results if one makes payments?

If you setup a lifetime mortgage the place you have made regular focus payments, this may has assisted to save the costs off from the maybe not allowing all of the desire so you’re able to accrue. The bill of your own loan are repayable pursuing the passing otherwise transfer to long lasting enough time-identity care of the last debtor.

In case the beneficiaries consult a monetary agent?

Sorting out your collateral discharge plan once your dying would-be generated simpler for your executor and you can beneficiaries if you have left an obvious bundle with specifics of your personal debt towards your security discharge provider.

When your collateral release package was at shared names and another partner enjoys died, it can be value revisiting the master plan by the talking to a monetary agent for these reasons:

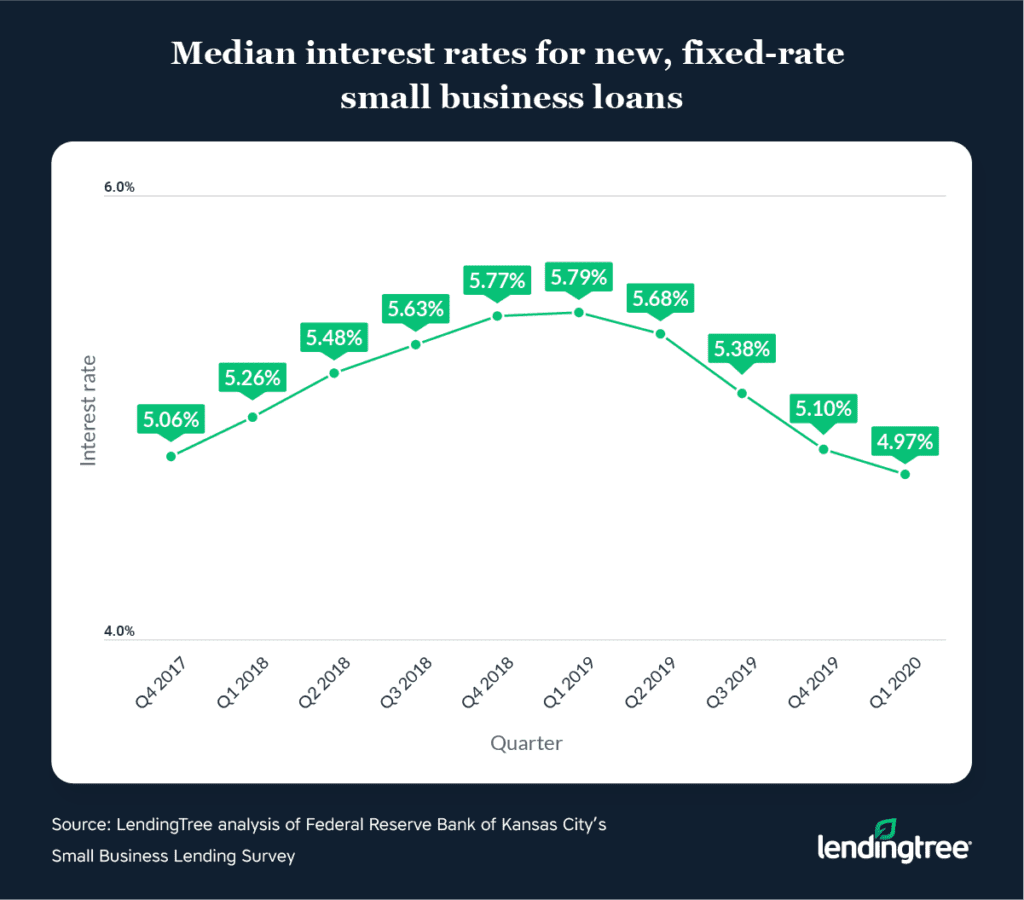

- For those who have an existence home loan, interest levels is generally below if the package are place up-and a more recent bundle could be finest ideal for new left partner’s changed products

- In the event the household income is leaner, it will be worth re also-running benefit monitors to see if more help is offered

- If for example the enduring mate desires circulate family then they can get need to look at whether or not the the fresh new property fits this new provider’s financing requirements, or if perhaps early installment fees you are going to use

- With a mutual house reversion package, they constantly actually it is possible to to make change for the initial agreement and paying back brand new collateral early will get happen very early cost fees.

Leave a Reply