Regardless of if to find a house remains problematic to own lowest-income houses even if he is signed up for IDAs, studies show you to clients engaging in IDA software had been likely to become people more quickly than just nonparticipants had been

Homeownership is actually a switch rider out-of IDA involvement and extremely preferred offers goal into the apps where complimentary funds can be used to find a home. 24 It in search of framework, while the complimentary pricing are often highest getting homeownership or microenterprise specifications than for degree and other spends. twenty five In addition to the matched up deals, IDA applications generally bring prepurchase homeownership counseling and you will recommendations inside (and sometimes direct supervision out of) home loan equipment choices. twenty six Even in the event to order a property is the most preferred entry to IDAs, Schreiner and you may Sherraden’s writeup on Include discovers this particular mission was including with the incapacity to do IDA software: On the that-half of IDA people when you look at the Add desired to rescue to possess home pick, and generally are inclined to decrease away compared to those planning for almost every other coordinated uses. twenty seven The fresh new article writers trait it change to help you a couple of facts: one certainly system users, renters are probably worse savers than those that are property owners, and this the procedure for buying a home is more difficult and you will expensive than simply that to many other possible spends making people a great deal more planning to be disappointed and you can drop-out. 28

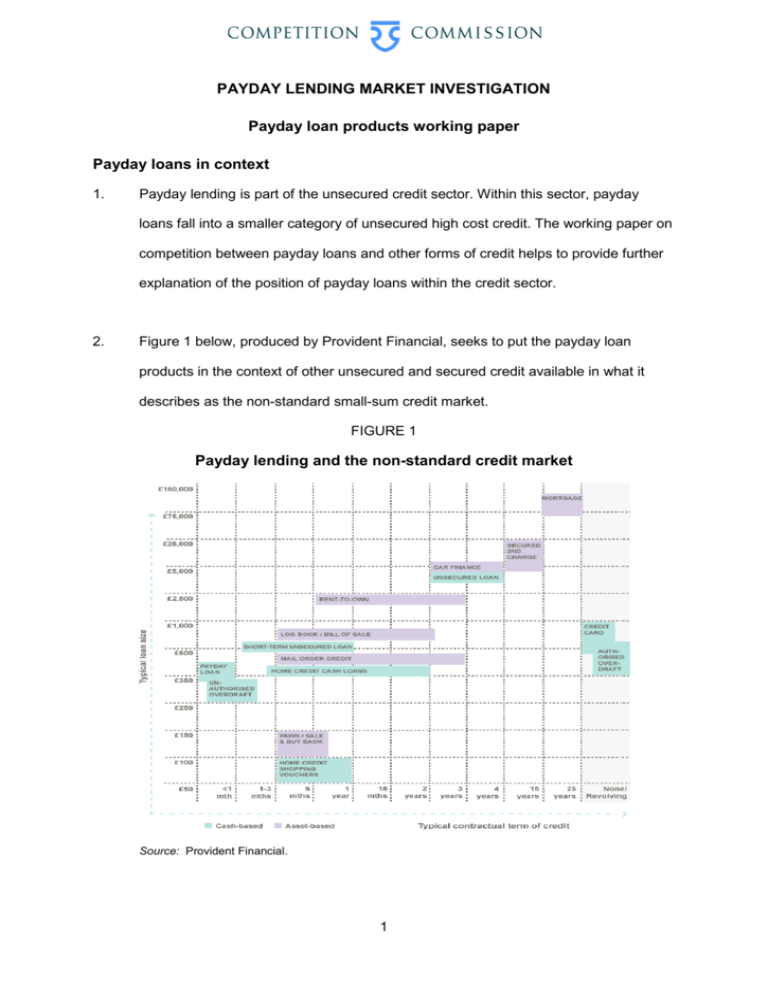

The Tulsa Incorporate program website planned its IDA system while the a beneficial randomized test, and also the consequences at this site were greatly examined. Grinstein-Weiss ainsi que al. checked Tulsa clients from the IDA new member classification and manage classification within four episodes: at the start of the system; 1 . 5 years to the program; within 4 decades, when the system finished; and you will ten years following the beginning of the system. The treatment category received financial knowledge and you will instance administration functions in the addition to matched up offers, whereas brand new control category didn’t have the means to access coordinated deals but can seek out homeownership counseling off their providers from the town. 29 New scientists learned that, within cuatro decades, brand new odds of getting a citizen was basically 75 percent highest toward medication class compared to brand new manage classification, dealing with getting market and you can economic version. 31 In addition, cleaning dated costs looked like a critical step-on the newest road to homeownership; thirty-two % of IDA participants who had said cleaning dated bills on 18 months was homeowners after 4 age compared with fifteen percent regarding IDA people whom didn’t obvious debts and you will nine.six per cent of low-IDA users just who don’t report cleaning their debts. 29

However, previous preliminary research by the Grinstein-Weiss although some toward long-label followup performance shows more weaker outcomes of IDA participation towards the homeownership

10 years pursuing the program began, one another procedures and you can manage teams had educated highest growth in homeownership, and you will one of several full class no mathematically significant effect of IDA involvement are obvious. But not, towards the subgroup of men and women which have a lot more than-sample average yearly revenues at the baseline (on $fifteen,five-hundred a-year), assignment on the therapy class rather increased this new homeownership rates and you will duration of homeownership. thirty two New article authors suggest that that it wanting you’ll support targeting IDA software with an effective homeownership aspect of the individuals on the high-end cash qualifications. Brand new writers including recognize the cousin simple low-money domestic buy ranging from 1998 and you will 2007, the fresh new relatively reasonable homes costs from inside the Tulsa during this time period, and the supply of option homeownership advice with the manage class might have dulled this new long-term effects of IDA participation on homeownership regarding try out. 33

Browse means that IDA professionals just are likely to feel homebuyers earlier than most other https://availableloan.net/installment-loans-mo/ lowest-income persons as well as are far more profitable people. Rademacher mais aussi al.is why 2010 blog post Weathering new Storm: Provides IDAs Aided Lowest-Money Homebuyers Avoid Foreclosure? examines the results from 831 homeowners out-of 6 IDA software ranging from 1999 and you will 2007, review individuals homeownership actions against an assessment class built with House Financial Revelation Operate (HMDA) or any other financial results studies supply. 34 New scientists unearthed that minorities and you may women written a significantly higher ratio off homebuyers from the IDA shot than in the review sample out of lowest-money homeowners: New ratio off Dark colored homeowners throughout the IDA test are more 3 x more than from the HMDA shot, as well as for Latina homebuyers, the new ratio was step one.5 times highest. Likewise, 73.5 percent of your own IDA homebuyers are female compared to forty-two.six % of your HMDA sample. thirty-five Women and you can minorities was indeed more likely to receive subprime mortgages during the period of this study. IDA homeowners on cures category, but not, gotten bodies-insured money and you may prevented subprime and you may highest-attention fund in the greater size than just performed the non-IDA alternatives, probably because of their use of guidance and continuing mortgage equipment overseeing in addition to their ability to make higher down costs than extremely reduced-money homebuyers you will definitely. thirty six

Leave a Reply